Cyber risk is unlike any other and traditional risk evaluation practices aren’t cutting it.

Try SecurityScorecard’s Business plan free for 14 days to see how real-time data and analytics platform can help you gain risk insights into today’s risks and keep pace with emerging threats and vulnerabilities.

As a user, you can also run a free one-time CRQ analysis!

Start embracing change and make the shift to real-time cyber risk evaluation and mitigation

-

LEARN ABOUT THE SHIFT

Discover why continuous underwriting is the new standard for winning in a rapidly changing cyber insurance market

-

CLAIM YOUR SCORE, INSTANTLY

See how SecurityScorecard rates your cybersecurity posture and the likelihood of a data breach. Now includes free account access to continuously monitor your score.

-

SPEAK WITH SALES

Get a holistic view of any organization’s security posture based on the collection, analysis, and attribution of millions of critical data points.

Continuous Underwriting Benefits

-

CONTINUOUSLY EVALUATE RISKS

Become hyper aware of cyber threats, vulnerabilities and their impact on the insurability of an applicant or policyholder.

-

IDENTIFY RISK MITIGATION STRATEGIES

Parse out the drivers of cyber risk and directly tie those findings to specific security recommendations that improve insurability.

-

INCREASE POLICYHOLDER ENGAGEMENT

Share your cyber risks insights and maintain an open and active line of communication with policyholders.

Continuous Underwriting Tools

Capabilities for successfully implementing continuous underwriting

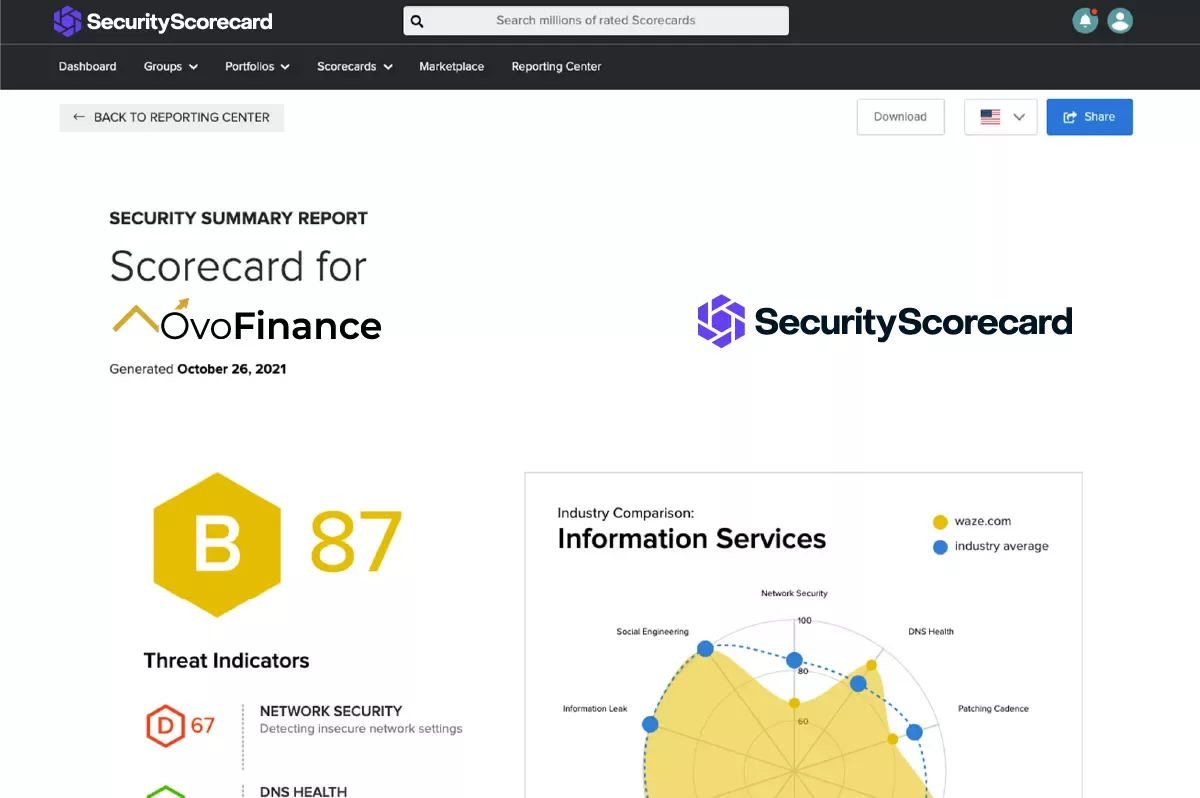

A THROUGH F SECURITY RATINGS

Easily understand and communicate the security posture of any policyholder or applicant before, during, and after the underwriting process.

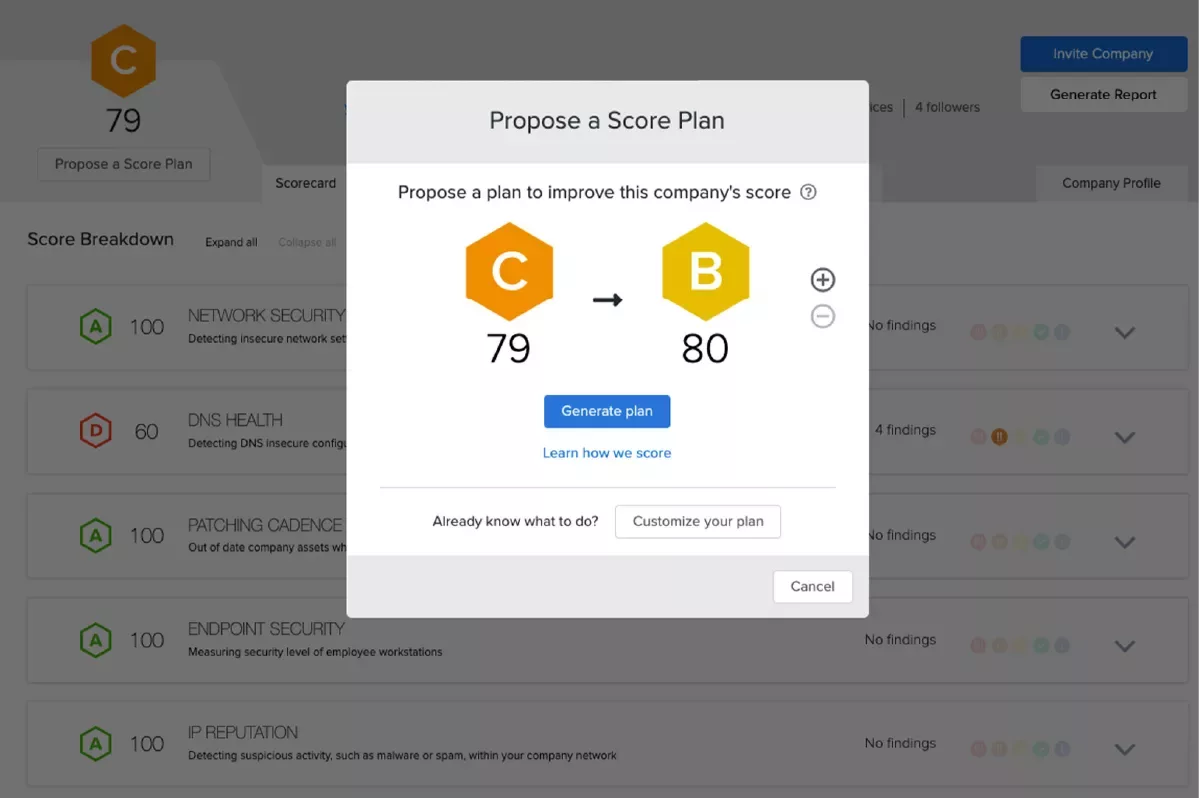

SCORE PLANNER

Determine and prioritize the security enhancements that will lead to the greatest improvements in an applicant or policyholder’s insurability.

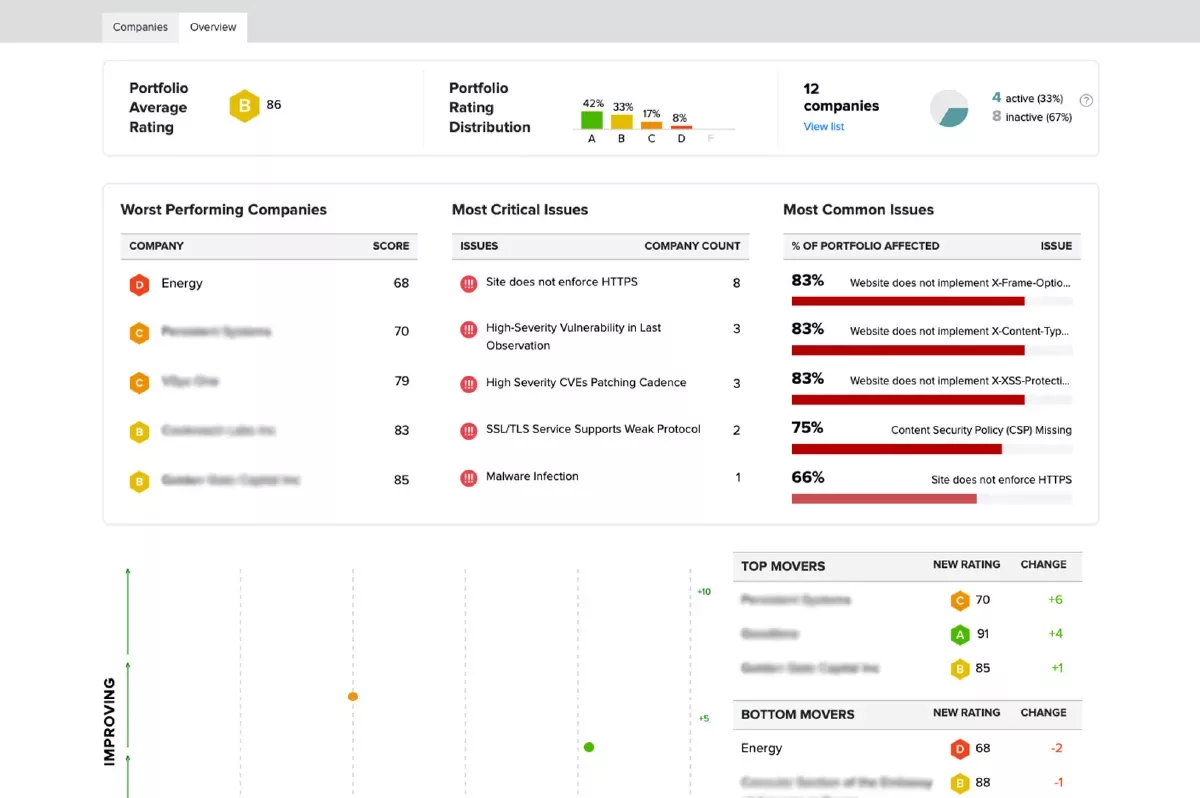

PORTFOLIO MANAGEMENT

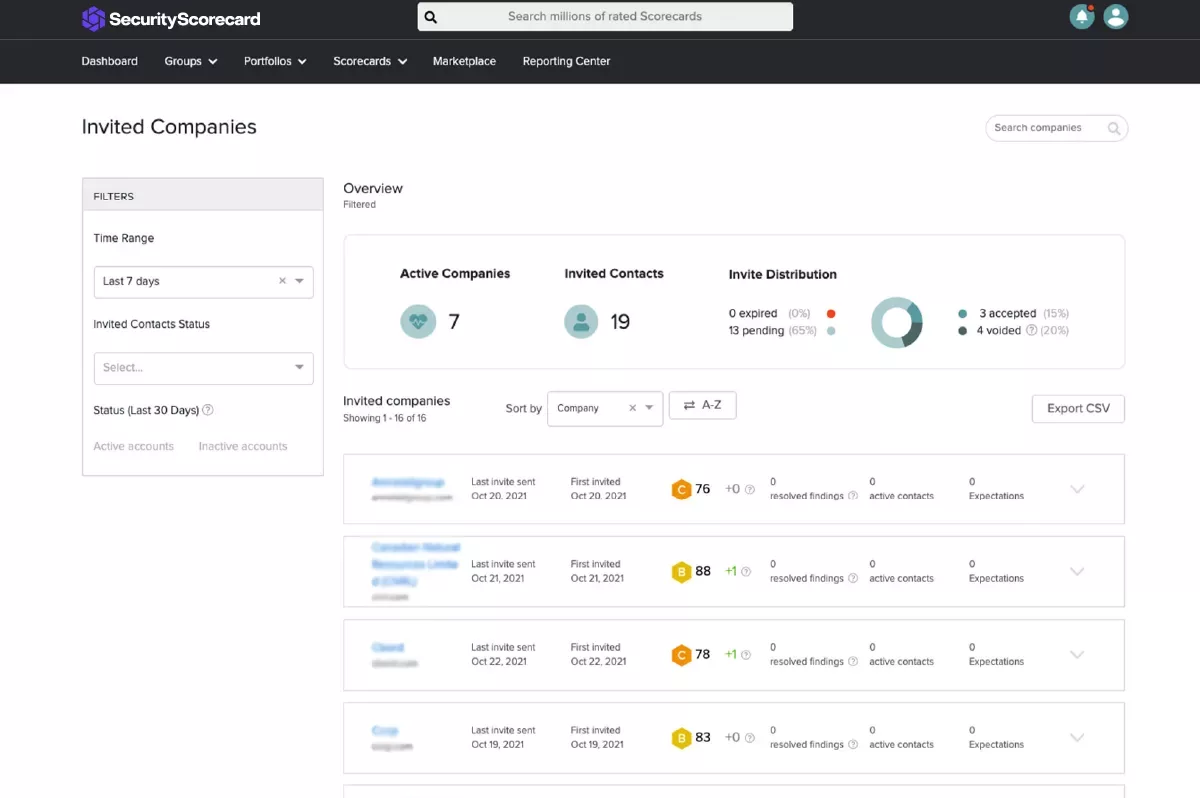

Organize your portfolio of insureds, capture risk or performance trends and obtain insights into the systemic risks that drive catastrophic losses.

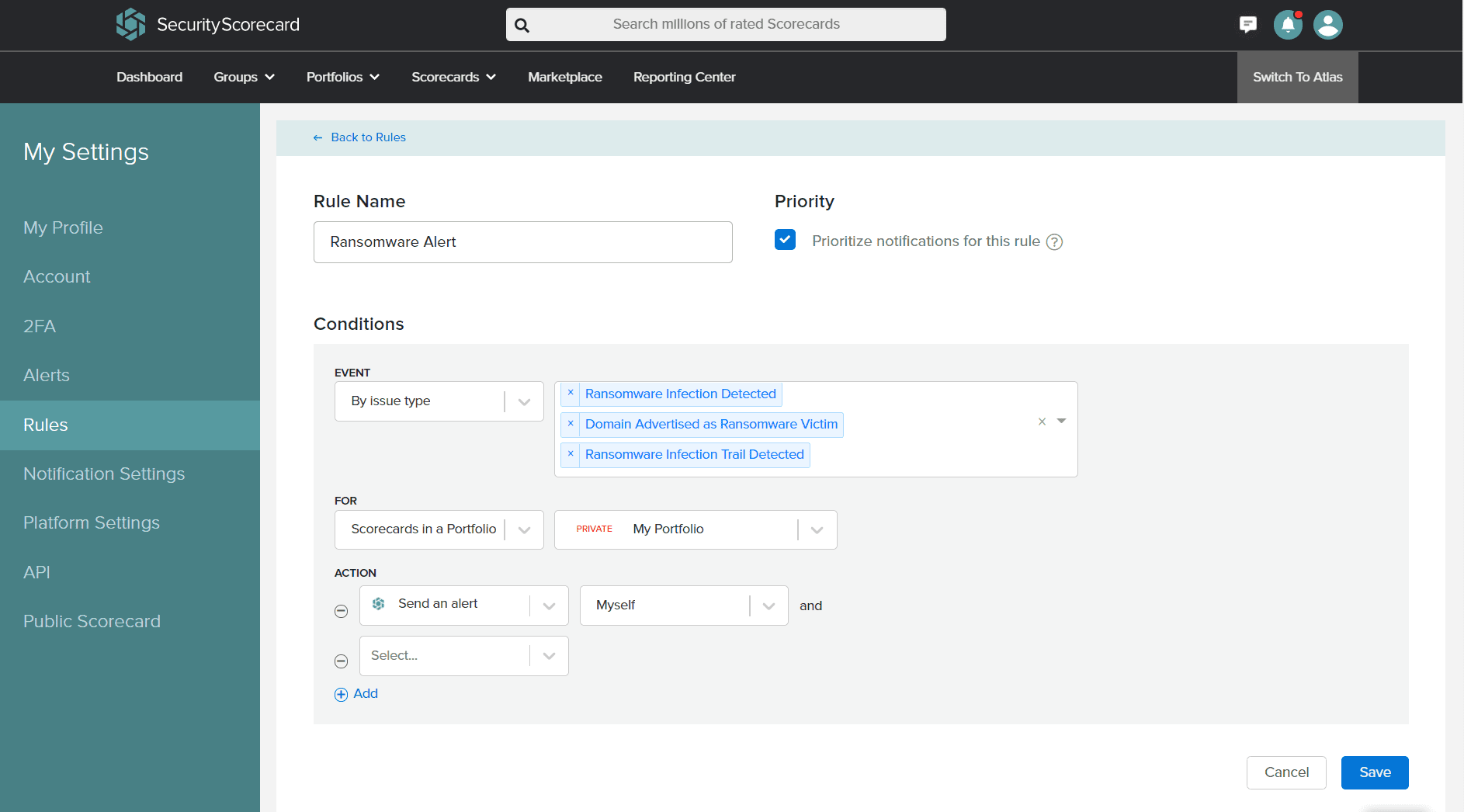

AUTOMATED ALERTS AND NOTIFICATIONS

Keeps stakeholders informed of emerging threats, draw attention to drastic drops in an insured’s security score, kicks off risk- management workflows, and more without manual intervention.

FREE POLICYHOLDER ACCOUNTS

Invite your policyholders self-monitor and receive your cyber risk insights through the SecurityScorecard platform without any additional costs to you or the policyholder.